En artikel ur Ecological Economics som behandlar hur en modell kan se ut som försöker ta hänsyn till minskande EROI och vilka effekter detta kan ha. En tung artikel med mycket matematik.

Från Abstraktet:

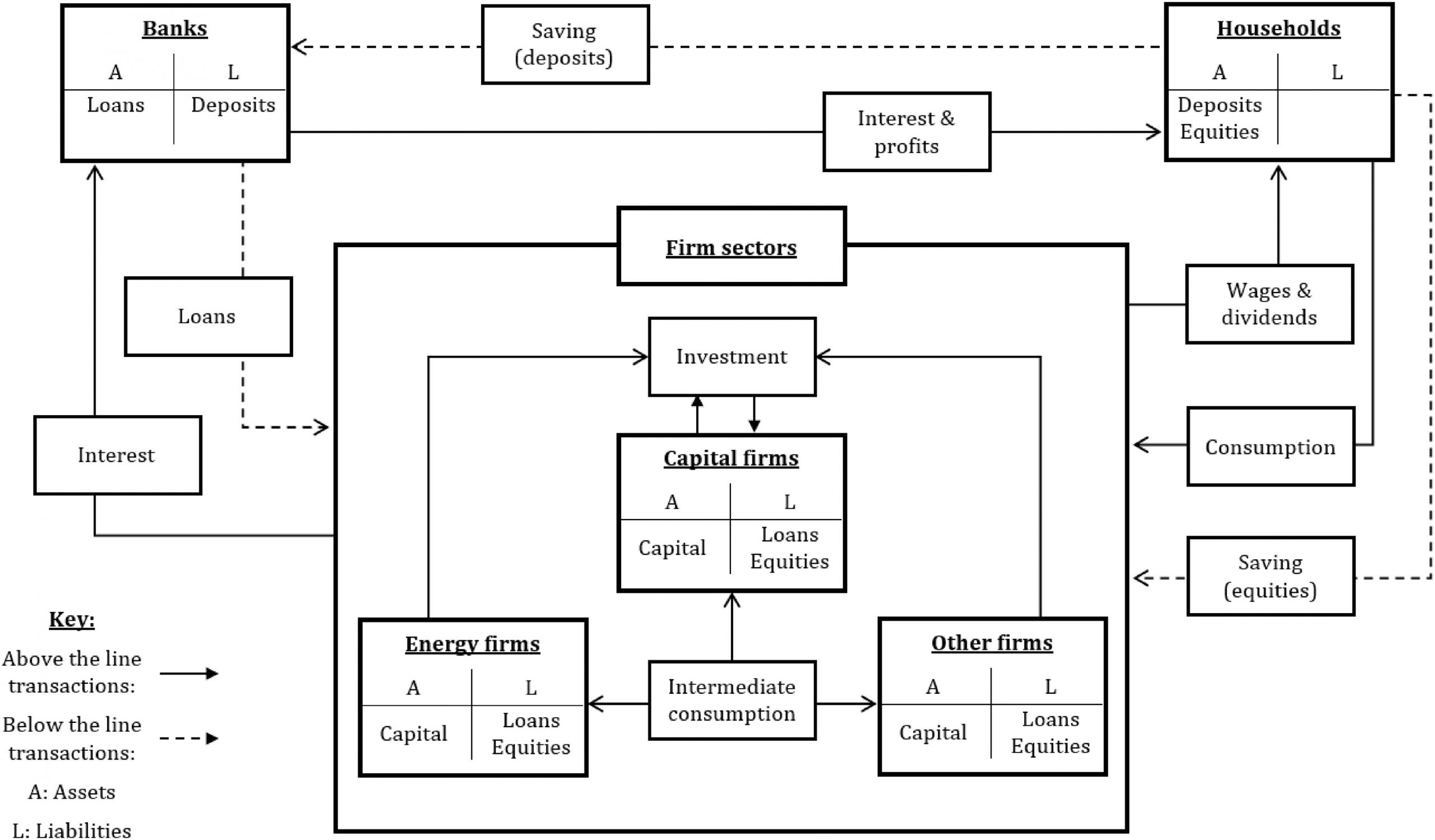

This paper develops a model (TranSim) which can simulate the economic and financial implications of an energy technology transition involving a reduction in EROI, by combining the stock-flow consistent (SFC) approach with an input-output (IO) model.

The TranSim model has the following key features. First, it includes three firm sectors, that produce energy, capital, and other (non-energy, non-capital) goods. Second, an IO model and an Almost Ideal Demand System are integrated into the SFC model. Third, capital vintages have embedded levels of labour productivity and intermediate good requirements that depend on the economic conditions in the period the vintage was produced.

Simulations are characterised by an initial increase in output (due to higher investment), followed by periods of recession and below trend growth (due to price inflation and changes to the functional income distribution). The negative effects associated with the transition – recession, stagnation, stagflation, increasing inequality and asset stranding – are positively related to the capital intensity of green energy production and reductions in EROI.

Källa: Modelling energy transition risk: The impact of declining energy return on investment (EROI) – ScienceDirect

__________________